georgia personal property tax exemptions

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000. Columbia County Tax Commissioners Office 101 W.

What Is The Role Of Tax Depreciation Schedule On The Property Of An Individual Income Tax Investing Insurance Broker

Georgias companies pay no state property tax on inventory or any other real or personal property.

. Of course these various rates mean individual tax. The states top marginal income tax rate of 575. These summaries also show how much tax is levied in the tax district and the millage rate for each tax district.

Many states and local municipalities offer property tax assistance to seniors the disabled and veterans. Phone 706 868-4252 Fax 706 868-3399. There are two types of tax exemptions available.

Exemptions reduce the assessed value of your property thereby reducing the amount of property tax you pay. Solar sales tax exemptions reduce the upfront cost of going solar. States Georgias tax system ranks close to the middle of the pack for the burden its tax system places on taxpayers.

Property tax exemption programs. These vary by county. Broader Tangible Personal Property Tax Exemptions.

Flat dollar exemptions are calculated by exempting a specified dollar amount from the value of a home. In addition to de minimis exemptions some states provide broader exemptions for a certain amount of TPP for all taxpayers. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas.

Ad valorem means according to value The millage rate is a determining factor in the calculation of your taxes. Likewise its average property and gas taxes are both near the national averages. During this period the Board of Tax Assessors determines the Fair Market Value of your property.

At the same time six states have property tax freeze programs that bar property tax. Nearly all states have homestead exemption and credit programs in place for seniors and other qualifying individuals to exempt a certain amount of a homes value from taxation. To be granted a homestead exemption.

The ad valorem tax more commonly called property tax is the primary source of revenue for local governments in Georgia. A As used in this Code section the term nonresident of Georgia shall include individuals trusts partnerships corporations and unincorporated organizations. Flat dollar and percentage exemptions.

If your property is your permanent residence or homestead you may be eligible for a tax exemption. Page 5 Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16 Taxation of Financial Institutions Page 16 About Unclaimed Property Page 17 2 Property Taxation Property tax is an ad valorem. Withholding tax on sale or transfer of real property and associated tangible personal property by nonresidents.

GROVETOWN OFFICE Open Mon - Fri 800 am - 430 pm excluding holidays Location. The Tax Digest Consolidated Summary also known as consolidation sheets depicts the assessed totals of all property listed on a Georgia countys tax digest separated by tax district. Universal exemptions avoid the tax cliff that de.

A tax return is not required unless assessed changes are made to the property that would increase or decrease the value of the property. GDVS personnel will assist veterans in obtaining the necessary documentation for filing. 48-5-40 LGS-Homestead- Application for Homestead Exemption.

If the owner thinks the value is too high for their property the property owner may declare a value and this would start the appeal. The actual filing of documents is the veterans responsibility. All property owners are required to have.

Evans Georgia 30809. January 1st to April 1st Homestead Exemptions. 560-12-2-62 now reads this Rule explains the sales and use tax exemptions in OCGA 48-8-32 for machinery and equipment necessary and integral to the manufacture of tangible personal property in a manufacturing plant for repair and replacement parts associated with such machinery and equipment and for industrial materials and.

All property owners are required to have a personal property tax return and application for exemptions on file in the Tax Assessors office by April 1st. Programs including homestead exemptions senior freezes payment plans deductions and lower assessments are some of the resources offered to individuals who meet income limits. Several types of exemptions are available.

17 states exempt that purchase from sales tax and five other states dont. Tax returns on personal property are filed with the Board of Assessors. If you live in a state with sales tax you could pay between 29 and 95 sales tax on the cost of a solar installation.

The assessed total is 40 of the fair market value of the property. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Property Tax Homestead Exemptions Generally a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence as of January 1 of the taxable year.

Learn more Distribution Centers. Solar sales tax exemptions and solar property tax exemptions. Property Tax Guide for Georgia Citizens Property Taxation Page 1 When Are Property Taxes Due.

Because of the unpopularity of the tax property tax limits have become common throughout the country. Distribution centers investing a minimum of 5 million in a new or expanded facility are eligible for sales and use tax exemptions on machinery and. Taxable property includes real estate public utilities tangible personal property boats airplanes and business inventory heavy duty equipment.

Below are key areas where Georgia tax exemptions lower start-up and operating costs. There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes. Combined state and local sales taxes in the Peach State average 733.

There are two broad types of homestead exemptions. A mill is 110 of 1 cent or 1 per 1000 of assessed value The millage rate multiplied by the 40 assessed. Florida for example provides a 25000 exemption for all property in the county where the property is used for business purposes.

The Property Tax Division of the Tax Commissioners Office are responsible for billing collecting and disbursing ad valorem property taxes administering homestead exemptions and the levy of property for delinquent taxes. Homestead exemptions are a progressive approach to property tax reliefthat is the largest tax cuts as a share of income go to lower- and middle income taxpayers.

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Debt Relief Programs

Veteran Tax Exemptions By State

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Income Tax Return

Standard Deduction Tax Exemption And Deduction Taxact Blog

Property Tax Exemptions Who Qualifies Rocket Mortgage

10 Ways To Be Tax Exempt Howstuffworks

Tax Benefits Of Owning Rural Land In 2021 Estimated Tax Payments Tax Deductions Business Tax Deductions

Property Taxes How You Could Be Getting Screwed Property Tax Estate Tax Tax Refund

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Income Tax Deductions List Fy 2018 19 How To Save Tax For Ay 19 20

Deduction Under Section 80g Of Income Tax Act 1961 For Donation

Slc Research Hospital Property Tax Exemptions In Slc States

Free Zone In Georgia Promotes Easy Business Setup For Offshore Companies Dubai Business Dubai Business Format

What Is A Sales Tax Exemption Certificate And How Do I Get One

What Is A Homestead Exemption And How Does It Work Lendingtree

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Old Or New Tax Slabs For Fy 2020 21 Amount At Which Tax Are Same Incometax Budget Unionbudget2020 Oldvsnew Income Tax Indirect Tax Budgeting

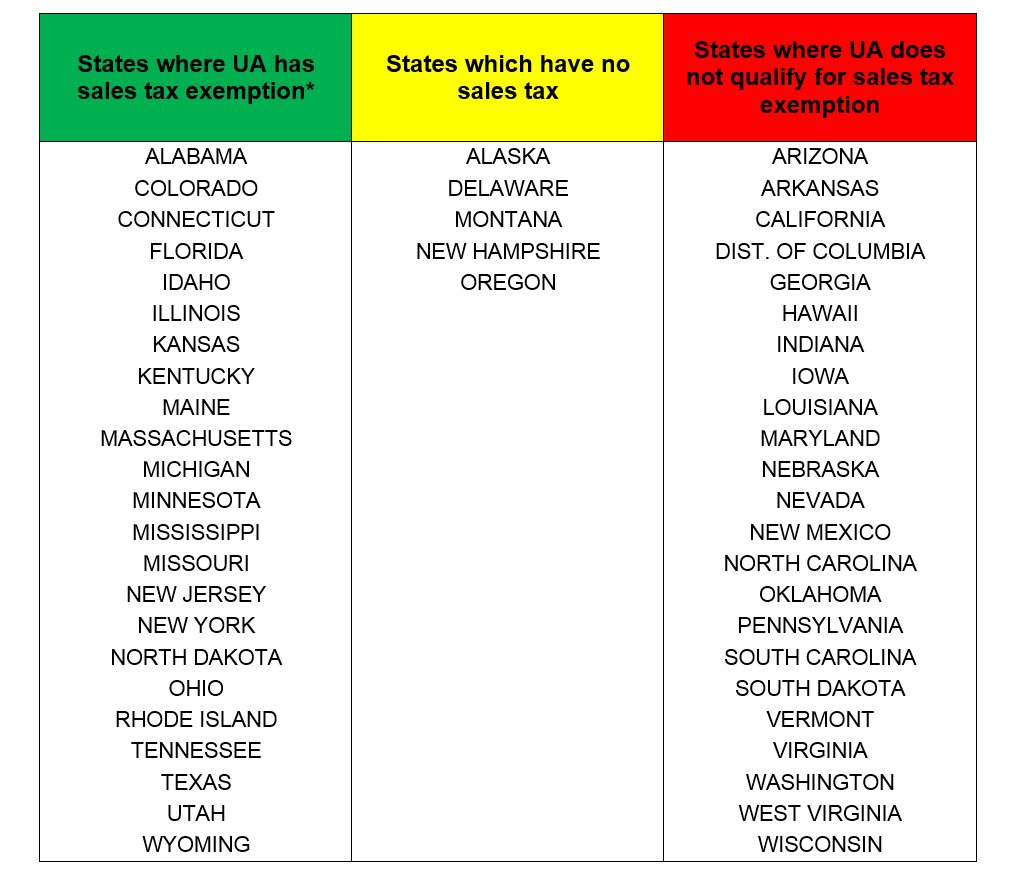

Other States Tax Exemption Tax Office The University Of Alabama